All Questions

What are Preferred and Select Pediatric Network Providers?

These are a subset of providers in the EHP network, plus certain providers in Florida that align with EHP benefits and coverage options.

EHP Preferred Providers include:

- Johns Hopkins Hospital

- Johns Hopkins Bayview Medical Center

- Howard County General Hospital

- Suburban Hospital

- Sibley Memorial Hospital

- Mt. Washington Pediatric Hospital

- Johns Hopkins Clinical Practice Association/School of Medicine

- Johns Hopkins Community Physicians

- Johns Hopkins Regional Physicians

- Johns Hopkins Part-Time Faculty

- The member companies of Johns Hopkins Care at Home

- Anne Arundel Medical Group

- Anne Arundel Medical Center

- Greater Baltimore Medical Center (GBMC)

- GBMC Health Partners

- Greater Baltimore Health Alliance

- Gilchrist Greater Living

- Bayfront Health St. Petersburg

- Moffitt Cancer Center

- Tampa General Hospital

- Sarasota Memorial Hospital & First Physicians Group of Sarasota (These Providers will be paid and considered as IN-NETWORK by EHP starting 1/1/2025 while contracting is finalized.)

EHP Select Pediatric Providers include:

- Johns Hopkins All Children’s Hospital and outpatient locations

- Johns Hopkins All Children’s Specialty Physicians

What is “Allowed Benefit (AB)”?

For any service or supply, the lesser of (1) the provider’s actual charge to the patient or (2) the amount that would be allowed by Medicare, increased by a percentage determined by Johns Hopkins Employer Health Programs, not to exceed 150% of the amount that would be allowed by Medicare. If Medicare does not provide an allowance for a service or supply, then Allowed Benefit means the prevailing, reasonable fee paid to similar providers for the same service or supply in the same geographic area, as determined by Johns Hopkins Employer Health Programs. EHP Preferred and EHP/CIGNA PPO Network Providers will not charge more than the Allowed Benefit, but Out-of-Network providers Out-of-Network can charge more and you are responsible for charges above the Allowed Benefit

What is “Allowed Amount”?

The maximum amount EHP will allow for the service(s) the patient received. Any copay and/or coinsurance amounts that the member is responsible for paying are deducted from the allowed charge.

What is an In-Network PCP?

A primary care provider is an EHP in-network internal medicine or family practice provider or pediatrician regardless of whether he or she is a EHP Preferred Network Provider.

Are there different types of copay card assistance programs?

Yes. There are two types of copay card programs offered:

- Non-Need Based: This type is offered to commercially insured populations. These copay cards may be used regardless of a patient’s financial status and do not require any form of eligibility or qualification to get assistance.

- Need-Based/Patient Assistance Program (PAP): This type is offered by a manufacturer sponsor or independent non-profit to help patients who meet specific financial eligibility criteria. These patients may be uninsured, underinsured or may have been denied coverage by commercial plans. This type of assistance is not part of the PrudentRx program, but your specialty pharmacy may be able to help you, if needed, in connecting with these types of programs.

What happens if I am already enrolled in a manufacturer copay card assistance program?

You will continue to fill prescriptions as usual. The integration between the pharmacy and PrudentRx will ensure the copay assistance is applied toward the member cost share by the pharmacy and that the pharmacy has visibility into your PrudentRx program enrollment status.

What is the process for obtaining specialty copay assistance and ensuring that it is used when a prescription is submitted?

If you or a covered family member take one or more specialty medications included in the PrudentRx drug list, you will receive a welcome letter from PrudentRx on behalf of the plan that provides information about the PrudentRx program as it pertains to your medication(s). All eligible members’ enrollment will begin automatically in the PrudentRx program, but there may be additional steps required.

PrudentRx will also contact members if they are required to enroll in the copay assistance for any medication that they take. PrudentRx continuously monitors copay card utilization and will conduct proactive member outreach as needed, including re-enrollment in available assistance programs.

When a new prescription is received and processed by the pharmacy, there is an administrative process to capture the claim and perform outreach to the member. From there, the pharmacy will offer to transfer the member to PrudentRx or will provide the member with the PrudentRx contact information to complete any necessary steps for enrollment. Prior authorization (PA) and formulary are not affected by the PrudentRx program.

A trained PrudentRx member advocate will help the member enroll in the available manufacturer copay assistance program where applicable. This process usually takes less than ten minutes but may take up to five to seven days depending on the manufacturer process. The member will be informed throughout the process.

What happens if the manufacturer copay card is no longer offered?

Copay assistance is monitored on a regular basis to quickly respond to any changes that may impact the member. If a copay card is no longer offered and you are enrolled in the PrudentRx program, your final OOP cost will remain $0.

What if my medication requires a PA?

You need to go through the usual PA and appeals process before the medication is processed by the pharmacy. While your PA is being reviewed, you can still confirm enrollment or opt out of the PrudentRx program. If your medication is not approved, your doctor may be able to prescribe a different medication for you.

Are there limitations around when I can enroll or opt out of the program?

No. Even if you originally opted out of the program, you could contact PrudentRx to confirm you’d like to re-enroll in the program at any time. However, only those prescriptions filled after you have enrolled in the PrudentRx program will have a $0 OOP cost.

Can I enroll my dependent on their behalf?

Yes. A member can enroll a minor dependent on their behalf.

Will I pay $0 OOP for all my medications?

No. Only specialty medications on your plan’s PrudentRx program drug list are eligible. Any medication not included on the PrudentRx program drug list or that are otherwise excluded from the definition of specialty product will be adjudicated using the existing plan design for non-specialty products and would continue to take the appropriate plan applicable member cost share.

What if I start a different specialty medication?

If you start a new specialty medication, PrudentRx will contact you to assist with enrollment in available manufacturer copay assistance for the new medication or you can call PrudentRx at 800-578-4403.

Am I able to obtain my specialty medication listed on the PrudentRX Drug list at any pharmacy?

No. You may only obtain medications on the PrudentRx Specialty Drug List from CVS Specialty Pharmacies and Publix Pharmacies in Florida. If you are currently using one of these pharmacies, or have already transferred your prescription, you do not need to take any action. To transfer your eligible specialty medication, you may call CVS Specialty Pharmacy (800-237-2767), or Publix Pharmacy for residents in Florida, and let them know that you want to transfer your prescription(s) from your old pharmacy. They will assist you with the transfer. You can also call your prescriber and ask them to send a new prescription to one of these pharmacy locations too.

Am I able to obtain other medications that are not included on the PrudentRx list at any pharmacy?

Yes. Medications that are not on the PrudentRx Specialty Drug list may be obtained at the pharmacy of your choice.

How can I submit my claims online?

Login to your HealthLINK portal, (or create an account if you don’t have one yet), click “Claims Reimbursement Form” under the “My Health Plan” tab, click “Member Reimbursement Form” and fill it out. Step-by-step guide.

Is there an age restriction for flu vaccines?

Your doctor can determine if you should receive a vaccine based on CDC recommended guidelines.

What vaccines can I get at the pharmacy instead of my PCP’s office?

Members may obtain vaccines from a network provider or the vaccines listed below from a network pharmacy. The list below identifies vaccines available at a vaccine network pharmacy at no cost.

| Vaccine | Use | Copay when administered at a Vaccine Network Pharmacy | Recommended Age |

|---|---|---|---|

| Flu Vaccine | Flu prevention | $0 | Age 9 and over |

| Shingrix | Shingles prevention | $0 | Age 50 and over |

| Zostavax | Shingles prevention | $0 | Age 60 and over |

| Adult Pneumococcal | Pneumonia prevention | $0 | Age 18 and over |

Where can I get a flu shot?

All EHP members can receive a flu shot at their primary care physician’s office, an EHP vaccine network pharmacy, or an out-of network provider.

Primary Care Provider (PCP) office

All EHP members can receive a flu shot at their PCP office. If you are visiting your PCP just to receive a flu shot, your visit will be considered preventive.

Pharmacies

If the pharmacy you go to is one of our vaccine network pharmacies, your flu vaccine will be free. Please be advised that not all pharmacies are part of our vaccine network.

Find a pharmacy in our vaccine network. You must log into your CVS caremark account and click on Pharmacy Locator. You can search by location or name then click on “Advanced Option” and select the box for Vaccine network. Registration is required for first time users.

NOTE: ONLY APPLIES TO EHP MEMBERS THAT HAVE PHARMACY COVERAGE THROUGH EHP.

Non-participating providers

If you receive your flu shot from an out-of-network provider or a pharmacy that is not in our vaccine network, you will pay for the full cost of the vaccine. You may be reimbursed up to $58 depending on the type of flu vaccine you receive. Contact your plan administrator for more information.

How much does a flu vaccine cost?

If the pharmacy you go to is one of our vaccine network pharmacies, your flu vaccine will be free. Please be advised that not all pharmacies are part of our vaccine network. Find a pharmacy in our vaccine network where you can get the flu vaccination.

If you have questions about the flu, read more about it at www.cdc.gov/flu.

When should I get a flu vaccine?

Getting a flu vaccine early in the season is your best protection against the flu. Don’t wait until late in the season, because you might have already been exposed to the virus.

Are there different types of flu vaccines?

There are different types of flu vaccines, and the CDC recommends you receive whatever is available at your pharmacy or doctor’s office. However, the CDC does not recommend the intranasal flu vaccine, FluMist.

Can the flu shot give me the flu?

No, you cannot get the flu from a flu shot. The flu shot contains pieces of inactivated (dead) flu viruses, which help your body protect itself against the actual flu.

Why should I get the flu vaccine?

The flu is a serious contagious disease spread by coughing, sneezing, and nasal secretions. The Centers for Disease Control (CDC) recommends that everyone 6 months of age and older get the flu vaccine because it is the best protection against this disease!

How do I allow my doctor to see my Personal Health Record (PHR)?

You are able to grant your physician access to view your PHR but by granting this permission, you are allowing them – and other providers in their practice – to see certain information like past medical appointments, conditions, procedures or events, allergies, and medications, which is all housed in your PHR. To grant permission to view your PHR, log in to your HealthLINK@Hopkins account, click Permissions under My Health, and then click on the gray tab labeled Clinician Permissions. You will see a list of areas in your PHR for which you can grant viewing permissions. To add physicians to your Permissions List, click Add. You can then modify the areas that you’d allow them to see by clicking Modify. This permission can be revoked at any time.

Why do I sometimes see “data unavailable” in my HealthLINK account?

One reason may be that federal and state privacy regulations require us to protect certain information from being shared. Or, the data you anticipated has not been made available to us yet. For specific information about your record, please contact Customer Service.

Why aren’t my claims appearing?

Claims status will be updated to HealthLINK in 2-5 business days after your claim has been processed. Most claims are processed within 30 days after receipt. If you’d like to confirm receipt or check the status of a claim, you can also call Customer Service.

How do I submit a reimbursement claim online?

Follow the steps below to complete a Reimbursement Claims Form. Be sure to enter all the required information and attach proof of payment information for timely processing.

- Log into your HealthLINK member portal.

- Once inside your member portal, go to the “My Health Plan” menu and select “Claims Reimbursement Form.”

- Select the “Member Reimbursement Form” link. Note: You can also check the status of previously submitted claims on this page.

- If you have dependents on your account, a window with the dependents will show. Select the appropriate member.

- In the Claims Reimbursement Form, fill out all the required fields and include any supplemental information. Add your proof of payment as an attachment.

For more detailed instructions, click here.

What is “View Audit” in HealthLINK@Hopkins?

This button allows you to see all of your account transactions. If you’d like further information about any of the transactions, write down the complete transaction ID and contact customer service. The customer service numbers can be found below, or you can send a secure message by clicking Message Center in the top right corner of the HealthLINK@Hopkins screen.

What is a secure message and how do I send one?

A HealthLINK@Hopkins secure message is similar to an email. As a member, you are able to send messages to – and receive them from – the Customer Service Department and your Case Manager (if you are assigned one.) To get started, click on Message Center in the yellow top-right corner of your screen. From there click the New and new message box will open. Click on the Directory link for a list of possible recipient mailboxes. Type the mailbox name of the person or department you’d like to message in the Search For field. The number of unread messages in your inbox will appear next to the envelope symbol in the top right corner. You can view your sent, deleted and inbox mail by clicking Message Center and selecting the appropriate gray tab.

Why aren’t there any results when I search for a provider?

First, make sure you are spelling the provider’s name correctly. If you aren’t sure of the spelling, type in the first three letters and a list will generate all doctors with a last name starting with those letters. You can then browse the list manually. Your search may also be too narrow, meaning there are no providers with your selected criteria within your network. Broaden your search by typing %% in a field or leaving it blank. This will generate all providers within those fields. Lastly, your search may also be too broad, in that there are far too many providers with your criteria for a list to generate. You can narrow your search by selecting an option in a field. A list will generate only those doctors that fit your criteria.

How do I search for a provider?

Log in to your HealthLINK@Hopkins account. Click “Search a Provider” in the left column under Quick Links or, under the tab “My Health Plans” in the top navigation bar.

What happens if I can’t remember my HealthLINK password?

When registering for a HealthLINK@Hopkins account, you will be asked 2 security questions. In the event that you ever forget your password, you can reset your password by giving your username. You will have 24 hours to click on the link sent to your email. When you click on the link, you will be asked to answer the security questions. If you enter the wrong password 3 times, your account will be locked and you will have to call Customer Service directly at 1-877-814-9909 Member option #2. For security purposes, Johns Hopkins Health Plans outsources this Customer Service function to another company, HealthTrio. HealthTrio’s Customer Service will ask you your security questions. If you do not answer correctly, you will be locked out of your account until Johns Hopkins Health Plans is notified and can verify your membership. You will be contacted upon verification and you will be able to reset your password and access your HealthLINK@Hopkins account.

How do I set up 2 factor authentication on my HealthLINK account?

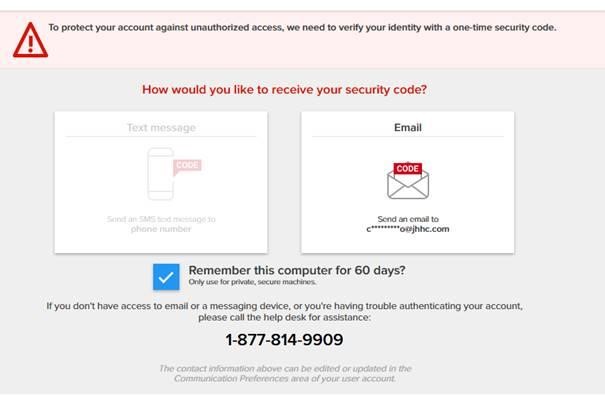

When you try to log into HealthLINK, after entering your user name and password, you will be brought to this page:

You will be prompted to receive a security code either through text, (if you have a cell phone number listed in your account) or by email. If you don’t have any cell phone listed in your account, you can add it later by scrolling down to the “Communication Preference” section of the Administration tab. (See the NOTE for instructions). If you request the code through email, and it does not appear in your inbox, check the spam/junk folder.

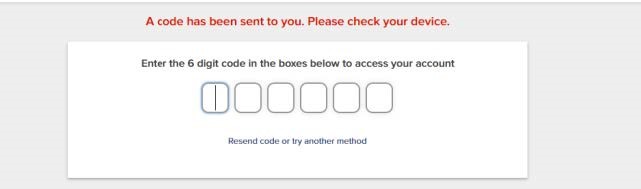

Enter the security code on the next screen:

NOTE: Changing Communication Preferences

After completing the two-factor authentication process using your email and successfully entering the HealthLINK portal, go to the Administration tab and scroll down to Communication Preferences.

- Go to “Edit Contact Details”

- Enter your mobile number and hit Save.

How do I register for a HealthLINK@Hopkins account?

Go to HealthLINK@Hopkins. Select “Member Register” under “First Time Logging In?” on the right side of the page. On the next page, enter your Member ID, name, birthdate and gender. Then follow the instructional screens to register and create a user ID and password. Your password must be nine characters and must contain at least one uppercase letter, one lowercase letter, one number, and one special character, such as #, *, or @. Usernames and passwords are case-sensitive.

Remember: your password is private so don’t write it down or keep it in a public space. Once the process is complete, you will be able to access your account.

What is the CIGNA PPO Network?

The Cigna PPO network supplements the EHP provider network. It gives EHP members access to more than one million providers and hospitals nationwide, including Maryland. EHP covers all health care services received from providers in the Cigna PPO network at the in-network benefit level. You may use a Cigna PPO network provider as your primary care provider. Search the Cigna PPO network

How do I receive a replacement identification (ID) card?

Contact Customer service at 410-424-4450 or 1-800-261-2393; or request one online, through your HealthLINK account. Please allow 7-10 business days for your ID card to arrive.

What is HealthLINK@Hopkins?

It’s our online health information portal. It is free to use and allows you secure, 24/7 access to your health information.

How do I obtain a listing of PCPs and Specialists that participate with EHP?

Use the Provider Search Tool or contact Customer Service at 1-800-261-2393 or 410-424-4450.

How do I change my Primary Care Physician (PCP)?

You can change your PCP by calling an EHP Customer Service Representative at 1-800-261-2393 or 410-424-4450 or by filling out and faxing back the Change your PCP form. You can also change or designate your PCP by logging into your HealthLink account. Your approved PCP change will become effective the day EHP is notified.

When should I go to the emergency department and how are emergency services covered?

An emergency medical situation is one in which a prudent layperson determines that immediate care is needed as the result of a sudden and serious illness or injury; and care is required to prevent:

- permanently placing your health in danger;

- causing other serious medical consequences;

- causing serious impairment to bodily functions; or

- causing serious permanent dysfunction of any bodily organ or part.

- For treatment of an emergency medical situation as described above, your care will be covered, regardless of whether or not the emergency room facility participates in the EHP Network. ER co-pays will be waived if you are admitted. However, if you go to the emergency room for services that are not deemed sudden and serious, payment will not be made.

What is an Out-of-Network Provider?

A provider or facility who is not contracted with EHP to provide services is considered “out-of-network.”

What is an In-Network Provider?

A provider or facility who has contracted with EHP to provide services is considered “in-network.”

How do I find out more information about medication pre-authorization?

Some medications require pre-authorization from our plan before they can be dispensed by your pharmacy. This helps us ensure that your prescriptions are medically necessary. To determine if a medication requires pre-authorization, refer to the Advanced Control Formulary. Information about covered medications, medication pre-authorization requirements and pharmacy plan benefits are available here.

Where can I find information about Mental Health Parity?

Please email mentalhealthparity@jhhp.org if you have questions or need information related to Mental Health Parity.

Who has access to my personal health information (PHI)?

The employees at EHP, who have signed confidentiality agreements, have access. You may also complete an Authorization For Use Or Disclosure Of My Protected Health Information form, which allows anyone you choose to access your information, e.g. spouse, adult child, etc. Please see the HIPAA Privacy page for further information and forms.

Who do I contact to change my personal information?

Please contact your Benefits Service Center or your Human Resources Office.

What is a Site of Service?

Site of service is a term used to indicate the facility in which you receive care. Many surgical procedures can be performed safely in an outpatient hospital setting, such as an ambulatory surgery center (ASC). Certain procedures require pre-authorization when performed in an outpatient hospital setting. For information on covered outpatient services, refer to your EHP Benefits Explorer.

How do I get a replacement card for Delta Dental?

Request a Delta Dental replacement card with the convenience of your Delta Member Dashboard, or contact Customer Service at 800-932-0783 to make your request.

When do I need to submit claims?

If you receive care from an in-network provider, that provider will submit the claim. However, if you receive out-of-network care, you are required to pay for the service, and then submit a claim form, as soon as possible to Johns Hopkins EHP for reimbursement. Most plan members have one year from the date of service to submit their receipts. Refer to your Summary Plan Description (SPD) to see if this applies to you.

How do I file a complaint?

If you have a complaint about EHP, you can call EHP Customer Service at 1-800-261-2393 or mail the complaint to:

Johns Hopkins Health Plans

Attn: Complaints and Grievances Department, Johns Hopkins EHP

7231 Parkway Drive, Suite 100

Hanover, MD 21076

How do I get a replacement card for SuperiorVision?

Request a SuperiorVision replacement card with the convenience of your SuperiorVision Member Portal Account, or contact Customer Service at 800-507-3800 to make your request.

Where do I mail my claims?

Johns Hopkins EHP

Attn: Claims Department

7231 Parkway Drive, Suite 100

Hanover, Maryland 21076

How can I receive reimbursement for out-of-network care?

If you receive out-of-network care you may be required to pay for the service and then submit a reimbursement claim form. Submit the reimbursement claim form to EHP as soon as possible. Reimbursement claim forms are available at your Human Resources office, on the EHP website, or by calling EHP Customer Service at 1-800-261-2393.

What information should I include with my reimbursement claim form?

Fill out the Demographic information and attach a copy of the receipts of invoices associated with the claim to the reimbursement claim form. Proof of payment of the invoice can be in the form of a redacted credit card statement, an invoice showing no balance due or a cashed check image.

Check with your provider that the correct codes have been added to the form to ensure a prompt reimbursement. It is absolutely necessary to include all receipts or invoices in order for EHP to properly process the claim.

How long do I have to submit my receipts for a claim?

Most plan members have one year from the date of service to submit their receipts. Refer to your Summary Plan Description (SPD) to see if this applies to you.

What do I do if I don’t agree with the way a claim has been resolved?

You may appeal an adverse decision made in whole or for part of a service and request reversal or adjustment of a denied or paid claim. Clinical appeals are reviewed by a peer comparable to the ordering provider.

How long do I have to file an appeal?

A member or an authorized representative must file the appeal or request a review in writing to EHP within 180 days of the date of the denial.

When will I find out if my appeal was approved?

If you have not received the services that were denied, you will receive and appeal determination within 15 days. If you have already received the services that were denied you will receive an appeal determination within 30 days. If your appeal is considered urgent, you will receive a determination within 36 hours.

Where do I send my appeal?

By mail:

Johns Hopkins Health Plans

Attn: Appeals Department, Johns Hopkins EHP

7231 Parkway Drive, Suite 100

Hanover, Maryland 21076

By fax: 410-762-5304

What if my appeal is urgent?

For urgent appeals, please call 410-762-5383

What if I have a complaint about EHP?

Complaints can be called into EHP Customer Service or can be mailed to:

Johns Hopkins Health Plans

Attn: Complaints and Grievances Department, Johns Hopkins EHP

7231 Parkway Drive, Suite 100

Hanover, Maryland 21076

Where can I find specific information about my benefits?

To find specific information about what’s covered by your plan, use the EHP Benefits Explorer.

What is an EOB?

An EOB is an Explanation of Benefits. For more information about EOB, refer to the Explanation of Benefits Guide (PDF).

What is a Referral?

A referral is a written order from your primary care provider (PCP) giving you permission to see a specialist or receive certain medical services. Before you can see a specialist and be covered for that care, you will need a referral from your PCP. For information on getting a referral for care, refer to your EHP Benefits Explorer.

What is a Pre-Authorization?

Certain medical services and supplies require approval before they will be covered by your plan. Your Schedule of Benefits indicates which services, supplies or medications require pre-authorization. All pre-authorization requests are coordinated through your physician’s office, so your provider must ask for and receive approval before you receive care. Johns Hopkins EHP will review the service, drug or equipment for medical necessity. If pre-authorization is not given, then coverage for care, services or supplies may be limited or denied. Any costs for denied services that were the result of an in-network provider failing to receive pre-authorization are not your responsibility. For more information on pre-authorization guidelines through your EHP plan, refer to your EHP Benefits Explorer.

Is my newborn automatically enrolled?

No. If you have a newborn baby, you must enroll the newborn within 30 days from the date of birth. Please contact your Benefits Service Center or your Human Resources Office to do so.

What is the PrudentRx program?

The PrudentRx program combines an innovative specialty plan design strategy and best-in-class member experience to help lower spending, with members enjoying reduced costs. The program applies to all specialty medications in a Covered Class on the PrudentRx program drug list and allows members who are participating in the program to pay $0 out of pocket (OOP) for specialty medications, regardless of whether a copay card is available.

What is a third-party sponsored copay card or manufacturer copay card assistance program?

A third-party sponsored copay card, or manufacturer copay card assistance program, is a direct-to-consumer incentive manufacturers offer to promote brand loyalty and the use of brand-name pharmaceutical products. The copay card can also be used to lower OOP costs for eligible patients.

What is the phone number for the specialty appointment line?

What are the hours of operation for the appointment line?

Monday through Friday, 8 a.m. to 5 p.m.

What is the purpose of this number?

This number is to assist all EHP members in scheduling initial specialty appointments with Johns Hopkins specialists.

I need a new primary care physician. Can I call this number to get an appointment?

No, this number is for initial specialty appointments with Hopkins specialists.

How does this service work to assist EHP plan members in particular?

All departments have committed to working with the specialty appointment line representatives to help improve EHP members’ access to Johns Hopkins specialty providers. This is a dedicated line for employees and their covered dependents. Where possible, clinics have set aside appointment times to accommodate EHP members.

Will this number allow me to see the specialist I want?

Whenever possible, the representative will get you an appointment with the physician of your choice. However, due to volume and/or availability, they may need to schedule your appointment with a nurse practitioner or physician assistant in the practice in order to get you in within a reasonable time frame.

I already see a Johns Hopkins specialist. Would this line help me get more timely appointments?

This line is mainly for securing appointments for EHP members who have not been successful in getting a first-time specialist appointment through the regular access lines. If you see a Johns Hopkins specialist on a regular basis, please try to schedule your next appointment at the end of your visit. However, if you are unsuccessful in getting a timely appointment, the specialty appointment line may be able to help.

What is considered a reasonable time frame?

This line is not intended to guarantee members a specific turnaround time; it is to ensure that whenever possible, EHP members will be seen in a reasonable period of time for their specific health issue.

What is “Pre-Determination/Pre-Treatment Review”?

Designed to give members and their dentist a better understanding of the benefits payable under the Dental Plan before services are provided. A pre-treatment review is recommended if dental services are expected to cost $500 or more, or for certain treatments including bone surgery, bridges, crowns, inlays (post and core) and onlays, periodontic procedures, and veneers. For any of these treatments, we recommend that the member’s dentist provide a proposed course of treatment and a pre-treatment estimate.

Who should I contact with questions or concerns?

Please let the access line representative you speak with know of any questions or comments you have and they should be able to direct you.

What is “Pre-Authorization”?

Required medical review of requested services before they are rendered.

What is “Allowed Benefit Charge”?

The usual fee charged by similar providers for the same services or supplies in the same geographic area. Johns Hopkins Employer Health Programs (EHP) determines what is a Allowed Benefit. Non-network providers can charge more. For more information, look under the heading “Payment Terms You Should Know” in your Summary Plan Description (SPD). You are responsible for any charges above R&C.

What is “Out of Pocket (OOP) Maximum”?

Maximum

The maximum amount the member pays for medical expenses during a plan year. After you meet the annual deductible, you pay the applicable coinsurance percentage (usually 10% or 20%) until you reach an annual medical out-of-pocket maximum. After you reach the medical out-of-pocket maximum, benefits for covered services are paid at 100% for the remainder of that calendar year. The out-of-pocket maximum includes the deductible, coinsurance, and co-pays; but does not include penalties; prescription drug co-pays and expenses; amounts in excess of the Allowed Benefit; amounts in excess of Plan maximums; or any charges for services which are not covered.

*For Broadway Services Inc.: The maximum amount the member pays for medical expenses during a plan year. After the member has paid the annual out-of-pocket limit, the Plan pays any additional covered expenses at 100% for the remainder of that plan year. The regular out-of-pocket maximum includes the deductible and coinsurance, but does not include copays; penalties; amounts in excess of the Allowed Benefit; amounts in excess of Plan maximums; or any charges for services which are not covered.

What is “Coinsurance”?

Percentage of medical costs that the member shares with EHP. The member’s Schedule of Benefits or SPD will advise if he/she has a copay or coinsurance.

What is a “Copay”?

A flat fee the member must pay to the Provider at the time of service. Usually applicable to an office visit or prescription.

What is a “Deductible”?

The amount that the member must pay within the plan year, before EHP begins to pay benefits. The member’s Schedule of Benefits or Summary Plan Description (SPD) will advise if he/she has a deductible.

How can I get an emergency refill of medication?

Ask your pharmacist to enter an emergency refill override. Pharmacists have been notified on what code to use for the override. If your pharmacist has problems with how to override the claim, they should contact our Customer Service at 800-261-2393 for assistance. You must have a valid prescription or refills available.

How much medication can I fill as an emergency refill?

You may fill up to a 30-day supply for your maintenance medications.

How much does an emergency refill cost?

You will pay your normal copay for an emergency supply of medication.

How can I get my medications without leaving my home?

- Ask your pharmacy if they offer store delivery.

- Use a pharmacy with a drive thru.

- Ask a healthy family member or friend to pick up your prescription.

How do I sign up for mail order?

EHP Members may sign up for mail order with CVS Caremark Mail Service.

You can connect online at www.caremark.com. Sign in or register your account. Click “Order Prescriptions,” then click “Request a New Prescription” to enter your medication.

Your doctor can fax new prescriptions directly to CVS Caremark by calling 800-378-5697. CVS Caremark can also contact your doctor directly to obtain a new prescription for you. To get that process started, call CVS Caremark at 800-875-0867 or log into the CVS Caremark portal. Click on “Start a New Prescription > FastStart”. Be prepared to provide the names of your medicines and your doctor’s name and phone number.

You can download, print, fill out, and mail the mail service order form to CVS/caremark to enroll.

How long does it take for the medication to arrive from mail order?

Usually a mail-order prescription will get to you in no more than ten days.

Available 24/7

Need more help?

Our Customer Service team is here to assist. Contact us via phone or email with questions about your health plan: